Following are comprehensive FAQs related to The Real Estate Settlement Procedures Act (RESPA), a consumer protection statute that ensures consumers are provided with more helpful information about the cost of the mortgage settlement and protected from unnecessarily high settlement charges.

The most recent RESPA Rule makes obtaining mortgage financing clearer and includes a required, standardized Good Faith Estimate (GFE). The HUD-1 was also improved to help consumers determine if their actual closing costs were within established tolerance requirements.

Click the links below to view specific questions about those topic areas.

GFE – General

GFE – Written List of Providers

HUD-1 – General

HUD-1 – Page 1

HUD-1 – Page 2

HUD-1 – Page 3

Right to Cure and Tolerance Requirements

GFE – General

When must the GFE be issued?

A loan originator must issue a GFE no later than three business days after the loan originator receives an application or information sufficient to complete an application. This information consists of:

- Borrower’s name

- Social Security number (or other unique identifier) for all borrowers

- Property address

- Estimated value of the property

- Principal Limit

- Date of birth for all borrowers

May additional pages be added to the GFE to allow for all charges to be shown? If so, is it an addendum or an extension of page 2?

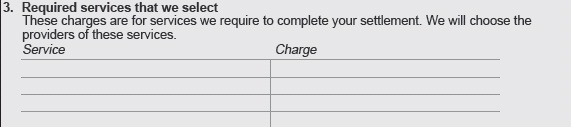

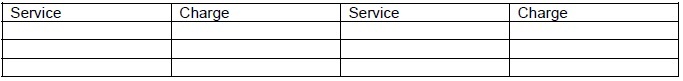

Additional pages or addendums may not be added to the GFE. The standardized GFE form is the required GFE form and must be provided exactly as specified, except that Blocks 3, 6, and 11 on page 2 may be adapted to use in particular loan situations, so that additional lines may be inserted there, and unused lines may be deleted. Lines may be added to Blocks 3, 6 and 11 vertically and horizontally as shown in the examples below.

Example: vertical line

Example: horizontal line

Example: horizontal line

Can the GFE be altered by adding signature lines?

Neither Liberty nor the broker can refuse to provide a GFE based upon a consumer’s refusal to acknowledge receipt of the GFE. Acknowledgement of receipt of a GFE, by itself, does not constitute an expression of an intention to proceed with the loan covered by the GFE.

Can items be listed as Paid Outside of Closing (POC) on the GFE?

No, the totals included in the column on page 2 of the GFE must be the sums of the fees for all settlement services that are required to be shown on the GFE.

If an application package is pulled from another competitors system, how will Liberty know the breakdown of the fees on the GFE.

Liberty will require a list of itemized fees at time of submission.

What field would be used when an attorney is involved in the transaction due to probate?

The Attorneys fees field.

Where would the loan originator put the lender and mortgage broker charges?

The total of all charges for all loan originators (lenders and mortgage brokers) must be contained in Block 1, “Our origination charge” on page 2 of the GFE, except for any charge for the specific interest rate chosen.

There is not a space in block 8 that addresses the tax certificate charge that title companies charge for checking to see whether or not property taxes are due. Do we use one of the spaces provided, or is there a way to add a line?

This fee should be included as part of their settlement fee, a separate fee is not permitted to be charged.

If we find there are property taxes due, do all taxes owed go beside the heading Municipality property Tax (city, county, school)?

If you’re referring to property taxes that are due on a periodic basis (e.g. twice per year for CA) then those would not be disclosed on the GFE. The taxes that would go on the GFE are fees for loans and home sales that are based on the loan amount or sales price (and state).

The title companies are providing fees for “escrow fee.” Is it okay to show this as “Settlement or Loan Closing Fee?"

Yes, they are one and the same. A request has been made to rename the field in the portal to “Settlement or Escrow Fee” so it is more clear.

If the title company bundles fees up into the title insurance fee, do we need to itemize these in the portal?

No, it is not uncommon to bundle fees but since it is not bundled in all states or all situations, we left them itemized on the GFE screen. You just have to remember to remove the fee defaults for those fees that are being bundled up into another fee (e.g. remove defaults for the notary and endorsement fees if they’re bundling them into the title insurance fee).

If at the time a GFE is issued it is known that the seller will pay settlement charges typically paid by the borrower, how are the charges disclosed on the GFE?

All charges typically paid by the borrower must be disclosed on the GFE regardless of whether the charges will be paid for by the borrower, the seller, or other party.

Are charges to the seller listed on the GFE?

Charges that typically would not be charged to the borrower, but would be charged to another party—such as the seller—do not have to be included on the GFE. If the borrower typically would incur charges for title services and lender’s and owner’s title insurance, those charges are required to be listed regardless of whether, for example, the contract requires the seller to pay for the service. If there is a question about whether the borrower or seller is to pay for a particular settlement service, the charge for that service should be disclosed on the GFE.

Once a GFE is issued, under what circumstances can the loan terms or charges increase and Liberty issue a revised GFE?

Examples of when a GFE can be redisclosed are:

- When the appraised value changes from the initial GFE

- When additional services will be required that were not reasonably foreseen when the initial GFE was provided (e.g. when requiring a pest or other inspection, survey, certification, etc.)

- Change in product (e.g. going from fixed to adjustable or vice versa)

- Borrower requests a change that will impact the fees on the GFE

Under what timeframe must Liberty or the broker issue the revised GFE?

Within three business days of receiving the information that resulted in the changed circumstance (e.g. if redisclosing due to higher value, we’d use the date the appraiser signed the appraisal to determine when the three business days starts ticking).

Who must issue the revised GFE?

The broker must issue the revised GFE using the redisclosure package available on the portal. Note: The 3 business days is triggered from the time the broker receives notification of the changed circumstance (i.e. the appraisal signed date for when changing fees due to an increased appraised value or other documentation resulting in the changed circumstance).

What documentation must be in the loan file when the GFE is redisclosed?

The loan file must have evidence of when the broker received the information regarding the changed circumstance as well as evidence the revised GFE was provided within 3 days. If the broker rediscloses the GFE, Liberty will require sufficient evidence that the revised GFE was provided within the required timeline (e.g. FexEx/UPS shipping confirmation, certified mail, etc.)

When the GFE is reissued, does the borrower have another ten business day period (or other amount of time as established by Liberty) to determine if they want to move forward with the loan?

Yes, the clock starts ticking all over again. The revised GFE will have the GFE expiration in number 2 on page one (as stated previously, it is currently set for current date plus 19 calendar days). If there is an express intent to continue prior to the expiration date, we may close the loan prior to the date. The loan file must be documented accordingly.

If circumstances change, may the broker issue a revised GFE with changes to all of the charges and terms related to the loan?

No, only those charges and terms that are affected by the specific changed circumstance may be updated on the GFE.

Are the following considered changed circumstances in which a revised GFE may be issued?

| Scenario | Changed circumstance? |

| A broker issues a GFE where Liberty believes the fees are under-estimated. | This does not constitute a changed circumstance. Liberty will be bound to the fees on the GFE within the specified tolerances. |

| FHA program changes | This could constitute a changed circumstance if the broker did not have notice of the FHA program change prior to the issuance of the GFE. |

| After the GFE is issued, parties are added to or removed from title. | This could be considered a changed circumstance. |

| The vendor originally selected to perform a settlement service goes out of business or stops offering the service. | The particular facts of each situation must be examined to determine if the facts constitute a changed circumstance. |

| After the GFE is issued, it is determined that an additional service such as pest, structural or other inspection, upgraded appraisal, certification, survey or other requirement is required by Liberty in connection with the transaction. | This could constitute a changed circumstance. |

| A broker issues a GFE based on one lender‘s loan products and origination fees, but places the loan with Liberty. | No, this would not constitute a changed circumstance. |

| Can market fluctuations be considered a changed circumstance (e.g. if the appraiser the broker intends to use raises its prices by $50 after the GFE was provided)? | No, this would not be considered a changed circumstance. |

| If a borrower was quoted a basic owner‘s title insurance policy, but requests an enhanced owner‘s title insurance policy or an endorsement to the owner‘s title insurance policy, should the loan originator issue a revised GFE? | If the borrower requests an enhanced owner‘s title insurance policy or an endorsement to an owner‘s title insurance policy after the loan originator issues the GFE, the loan originator may choose to treat such a request by the borrower as a changed circumstance. The loan originator may then choose to provide a revised GFE to the borrower to disclose the increased charges. If the increased charges do not exceed tolerances, the loan originator may opt not to issue a revised GFE. |

What if a document expires during the process (e.g. credit report, appraisal, etc.) and they have to be reordered which incurs additional fees. Does this constitute a changed circumstance?

This could constitute a changed circumstance. The facts of each situation must be reviewed to determine whether the GFE may be reissued.

If underwriting requests a desk review but the broker will pay the fee, must the GFE be reissued and would this constitute a changed circumstance?

The GFE would not need to be reissued since this fee does not impact the borrower.

What if the underwriter conditions for additional comps and the appraiser charges an additional fee to provide the comps?

This would not be a changed circumstance. In fact, there should not be an additional cost for providing additional comps, nor may the charge be passed onto the borrower.

GFE – Written List of Providers

When do loan originators have to provide the borrower with a written list of providers?

When a loan originator permits a borrower to shop for third-party settlement services, the loan originator must provide the borrower with a written list of settlement service providers at the time of the GFE, on a separate sheet of paper.

Does the borrower have to select a settlement service provider from the loan originator‘s written list of providers?

No. If the loan originator permits a borrower to shop for a settlement service provider, the borrower may choose a qualified provider that is not on the originator‘s written list.

If the borrower chooses a settlement service provider that is not on the written list, does the tolerance apply?

No, if the borrower chooses a settlement service provider that is not on the loan originator‘s written list of providers, the amount paid for that service is not subject to a tolerance.

HUD-1 – General

Where should the survey fee be disclosed on the HUD-1?

The location of the survey fee on the HUD-1 is determined as follows:

- if the loan originator required a survey as a condition of the loan and selected the settlement service provider, the charge for the survey must be listed on a blank line in the 800 series in the borrower‘s column;

- if the loan originator required a survey as a condition of the loan and the borrower selected the settlement service provider, the charge for the survey must be listed as part of the total in Line 1301 of the HUD-1 and itemized as applicable;

- if a survey was required to issue a lender‘s or owner‘s title insurance policy, the charge for the survey is part of the charge in Line 1101 and must be further itemized if performed by a third party;

- if the borrower elected to obtain a survey that was neither required by the loan originator nor required to issue a lender‘s or owner‘s title insurance policy, then the charge is listed in the borrower‘s column on a blank line in the 1300 series.

HUD-1 – Page 1

If the document prep fee is not permitted to be paid by the borrower, how must that be reflected on the HUD-1?

The full amount of the document prep fee must be disclosed in line 801 outside the column, and included in line 803 inside the column. The corresponding credit must be shown as a credit to the borrower on lines 204-209 showing as POC by Lender (or Broker).

What if at closing the seller is paying for a settlement service that was listed on the GFE, such as the Owner‘s title insurance policy? How is this shown on the HUD-1?

If the seller is paying for a service that was on the GFE, such as Owner‘s title insurance, the charge remains in the borrower‘s column on the HUD-1. A credit from the seller to the borrower to offset the charge should be listed on the first page of the HUD-1 in Lines 204-209 and Lines 506-509 respectively.

What are examples of charges that would be listed in line 104 and 105 on the HUD-1?

Lines 104 and 105 on the HUD-1 are for additional items owed by the borrower that are not on the GFE and items paid by the seller prior to settlement and being reimbursed to the seller from the borrower at settlement.

May a real estate agent rebate a portion of the agent‘s commission to the borrower? If so, how should the rebate be listed on the HUD-1?

Yes, real estate agents may rebate a portion of the agent‘s commission to the borrower in a real estate transaction. The rebate must be listed as a credit on page 1 of the HUD-1 in Lines 204-209 and the name of the party giving the credit must be identified. Real estate agent or broker commission rebates to borrowers do not violate Section 8 of RESPA as long as no part of the commission rebate is tied to a referral of business.

On which lines of page 2 of the HUD-1 is a person not required to be identified?

The general rule is that the names of all persons that received payment for each separately identified settlement service must be identified on page 2 of the HUD-1. There is not a requirement to identify persons on the following lines: 801, 802, 803, 901, the 1000 series, 1101, 1105, 1106, 1201, 1202, 1203, 1204, 1205 and 1301.

HUD-1 – Page 2

How is a payment from Liberty to the broker that will be paid outside of closing shown on the GFE and HUD-1?

All payments from Liberty to a broker must be shown as a credit to the borrower in Block 2 of the GFE and on Line 802 of the HUD-1. These payments may not be shown as P.O.C.

Where is the charge for flood insurance shown on the HUD-1? What if the borrower pays it prior to settlement?

Flood insurance should be disclosed on Line 904 of the HUD-1 with the charge in the borrower‘s column. If the borrower pays the insurance prior to closing, the item should be shown on Line 904 of the HUD-1 noted as P.O.C. with the charge listed outside the column.

If a title insurance underwriter is also the title agent, what should be shown on Lines 1107 and 1108 of the HUD-1?

If there is no premium split between the title underwriter and a separate title agent, all of the title insurance premium would be shown on Line 1108, and $0 would be shown on Line 1107.

If a borrower selects an attorney to represent the borrower‘s personal interests at settlement, where is this attorney‘s fee disclosed on the HUD-1?

If a borrower selects an attorney to represent the borrower‘s personal interests at settlement, and the service provided by that attorney is separate from the functions necessary to conduct the closing, provide title services or issue the lender‘s title insurance policy, this attorney‘s charge may be separately listed on a blank line in the 1100 series in the borrower‘s column along with the name of the attorney and the type of service provided. Accordingly, the amount of this attorney‘s fee should not be included in the charge listed on Line 1101.

If the title agent conducts the settlement, should the charge for conducting the settlement be included in Line 1101 of the HUD-1, with the itemized charge listed outside the column on Line 1102?

Yes, the charge for conducting the settlement must be included in the total on Line 1101. If the charge is paid to a third party, the charge must be itemized outside of the columns on Line 1102.

Where do I put the charge for the title commitment on the HUD-1?

The charge to the borrower for title services, including the charge for services related to the title commitment, must be included in the total in the borrower’s column on Line 1101. If a third party prepares and issues the title commitment, the disbursement for this service also must be itemized outside the columns on a blank line in the 1100-series.

How is the charge for conducting the settlement disclosed on the HUD-1?

The charge to the borrower for conducting the settlement must be included in the total stated in the borrower’s column on Line 1101 of the HUD-1. In addition, the total in the borrower’s column on Line 1101 must include any amount for conducting the settlement that was paid by another person on behalf of the borrower. In such a case, an offsetting credit must be shown on page 1 of the HUD-1. If the seller paid the amount, a credit to the borrower in that amount must be listed in Lines 204-209, and a charge to the seller must be listed in Lines 506-509. If another person pays the amount an offsetting credit is reported in Lines 204-209, identifying the person paying the charge. Any separate charge to a seller for conducting the settlement is listed in the seller’s column in Line 1102. The borrower‘s charge for conducting the settlement should be itemized outside the borrower‘s column in Line 1102.

If a title agent is sharing a portion of the title insurance premium with an attorney, is the name of the attorney listed in Line 1107 on the HUD-1?

On Line 1107 the settlement agent must record the amount of the total title insurance premium, including endorsements that are retained by the title agent. If a portion of the title insurance premium will not be retained by the title agent, but will instead be paid to an attorney, then a blank line in the 1100 series should be used to itemize, outside the columns, the amount paid to the attorney, and to identify the attorney’s name and type of service provided.

If there are additional government recording fees, such as to record a power of attorney or road maintenance agreement, are they included in Line 1201 of the HUD-1 or can they be charged separately?

Line1201 is used to record the total government recording charges. Additional items the lender requires to be recorded, other than those already enumerated in Line 1202, must be itemized on Line 1206. The charges for these additional items must be stated outside the column.

What charges are shown in the 1300 series of the HUD-1 Settlement Statement?

The 1300 series of the HUD-1 is used to record the charges for settlement services that are disclosed in Block 6 of the GFE as well as charges that are not disclosed on the GFE. Examples of some of these services may include charges for home inspections, radon inspections, and homeowner‘s warranty.

What charges are shown one Line 1301 of the HUD-1?

Line 1301 is the total of all charges for third party settlement services that the loan originator required but for which the borrower was permitted to select the service provider. The charge on Line 1301 is shown in the borrower‘s column. All charges included in the total amount on Line 1301 must be separately itemized outside of the columns in Lines 1302 and subsequent lines, identifying the type of service, the name of the provider, and the amount of the charge.

Where should the charge for the Homeowners Association (HOA) transfer fee be disclosed on the GFE and HUD-1?

The charge for the HOA transfer fee, unless it is a service required by Liberty, need not be disclosed on the GFE. The charge for the HOA transfer fee may be shown on a blank line in the 1300 series on the HUD-1.

HUD-1 – Page 3

How are items that were paid P.O.C. shown in the Comparison Chart on page 3 of the HUD-1?

The HUD-1 column in the Comparison Chart must include any amounts shown on page 2 of the HUD-1 in the column as paid by the borrower, plus any amounts that are shown as P.O.C. by or on behalf of the borrower.

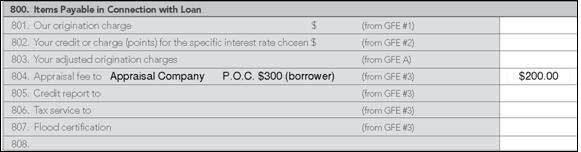

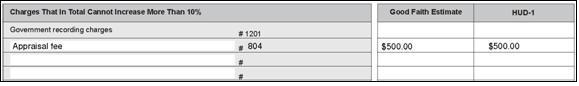

For example, if the borrower pays $300 towards required appraisal services, but the total charge for the appraisal is $500, then Line 804 on page 2 of the HUD-1 will show a P.O.C. amount of $300 outside the column and a charge of $200 in the borrower‘s column.

The total amount of $500 would be shown in the ―HUD-1 column ($300 P.O.C. + $200 at settlement) on a separate line in the comparison chart for charges that cannot increase more than 10 percent on page 3 of the HUD-1.

When completing the Comparison Chart on page 3 of the HUD-1, are all GFE Block 3 items (required services that we select) combined into one charge on one line, or should each of the items contained in GFE Block 3 be itemized separately?

Each item included in Block 3 on the borrower’s GFE must be separately itemized in the Charges That in Total Cannot Increase More Than 10% section of the Comparison Chart on page 3 of the HUD-1.

Right to Cure and Tolerance Requirements

What happens if the final fees at time of funding are more than what was disclosed and are outside the permitted tolerances?

The amount will be withheld from the broker’s compensation and a check sent to the borrower. Liberty will ensure the file is documented accordingly.

What’s the timeline in correcting overcharged fees?

30 calendar days from time of funding. Liberty will perform a Quality Control review on 100% of the loan files within 30 calendar days of funding and will correct any violations. Liberty will request a refund of the overage from the broker if the violation is found after funding.

If a loan originator pressures a settlement agent to reduce their charges or to cover the difference to bring the costs into compliance with the tolerances, is that considered a violation of RESPA Section 8(a)?

If a loan originator pressures a settlement agent (or other settlement service provider) to reduce their charges or otherwise cover the difference to bring the costs into compliance with the tolerances as a condition of receiving future referrals of business, it may be considered a potential violation of RESPA Section 8(a).